|

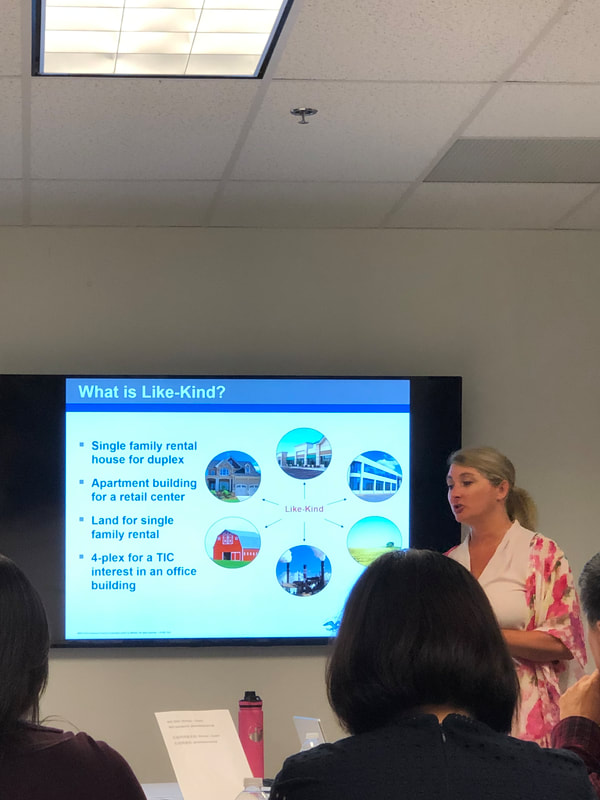

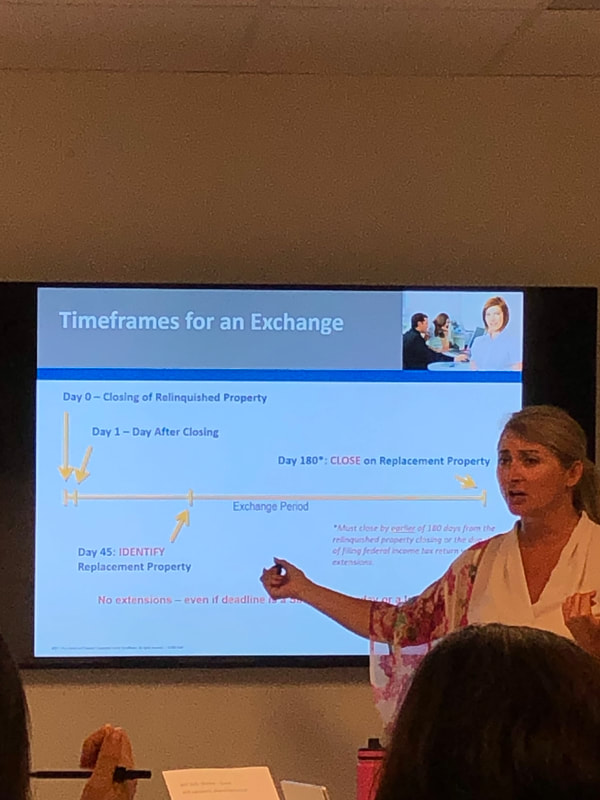

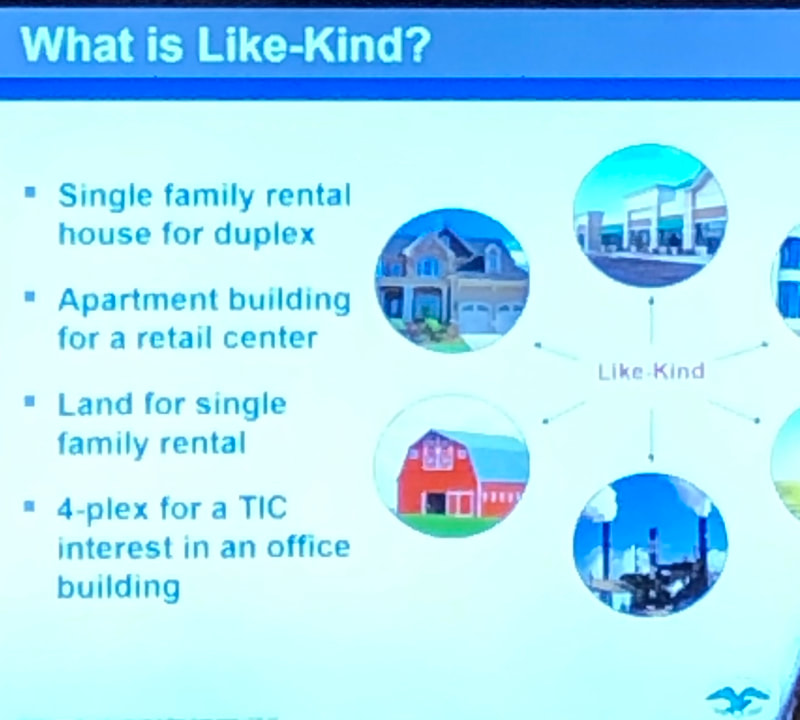

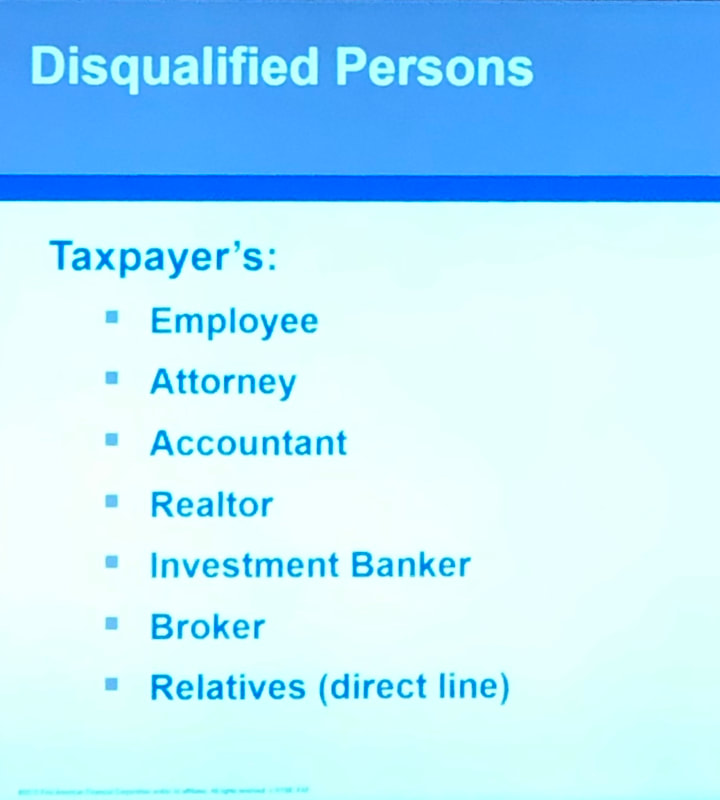

买卖物业时,“1031 税务递延交换”是国税局允许纳税人合法避税的一种税务策略 ,“1031”是对投资收益有很大影响的一个税务政策,如同借用政府的免息资金去做地产投资,也可说是杠杆原理的一种。 华盛顿州中国总商会CCCWA与西雅图地产俱乐部近期邀请First American 专家做一次有关房地产省税利器1031交换条款的讲座: 主讲人:Milissa Ormiston, Business Development Manager, Frist American Exchange Company 内容包括: · What is a 1031 Exchange and what are the requirements and qualifications? · Who is considered a qualified intermediary? · Property identification rules · How vesting should be held and related party issues · Reverse and improvement type exchanges · What to expect regarding closing costs related to a 1031 exchange · Lesser known exchange alternatives - Delaware Statutory Trust, IRC Section 121 and vacation homes; and examples of how to apply them 当日大家踊跃参加了这次讲座。

Comments are closed.

|

Archives

August 2020

|